The Unified AI solution engineered and designed for Insurers.

The purpose-built solution brings together everything insurers need to rapidly operationalize AI and Agentic AI - all together as one secure, enterprise-grade vertical solution built on top of DSW UnifyAI & DSW AgenticAI platforms.

25+ pre-built AI/ML use cases purpose-built for underwriting, claims, and fraud detection

300+ GenAI agents with agentic orchestration. Built, deployed, and managed using RAG, MCP, and A2A protocols.

Modular, low-code UnifyAI for building, deploying, and monitoring models at scale

AgenticAI for creating compliant, enterprise-ready GenAI agents in hours

Deployment options that suit your enterprise: on-prem, cloud, or hybrid infrastructure

25+ pre-built AI/ML use cases purpose-built for underwriting, claims, and fraud detection

300+ GenAI agents with agentic orchestration. Built, deployed, and managed using RAG, MCP, and A2A protocols.

Modular, low-code UnifyAI for building, deploying, and monitoring models at scale

AgenticAI for creating compliant, enterprise-ready GenAI agents in hours

Deployment options that suit your enterprise: on-prem, cloud, or hybrid infrastructure

Turn Common Insurance Tasks into Intelligent Agents

These aren’t chatbots. They’re intelligent teammates for your operations.

From claim status queries to automated underwriting support, this solution gives you 300 pre-built GenAI agents that are designed for real insurance workflows.

Key Capabilities:

01

Automate servicing, documentation, and communications with human-like agents

02

Use Retrieval-Augmented Generation (RAG), MCP and A2A protocols for smart, secure responses

03

Configure memory, tone, and rules for each agent

04

Deploy in hours with built-in monitoring and compliance guardrails

AI That Drives Results in Underwriting, Claims, Fraud, and CX

Go live with AI/ML use cases in 30 days and Agentic AI use cases in just few hours with enterprise-grade readiness right from day one. The purpose-built solution brings a library of ready-to-deploy AI/ML models and GenAI agents specifically designed for insurers to solve core challenges across the policy lifecycle.

Underwriting

Predict risk, segment customers, and reduce manual decisioning

Claims

Classify documents, assess claim legitimacy, and optimize settlement cycles

Fraud

Detect early signs of fraud with real-time pattern recognition

Trusted by Leaders in BFSI and Beyond

Explore how we’ve helped businesses like yours achieve success with innovative technology solutions.

With DSW's insurance-specific solutions on top of its robust AI platform, we’ve been able to move use cases into production quickly.

Ritesh Rathod

Chief Strategy and Data Officer, Canara HSBC

DSW UnifyAl simplified our data-driven approach, enabling easy development of Al-powered use cases.

Stefano Bonfa

Director, OxSDE, Europe

With advanced capabilities of the platform's AgenticAI, Castler’s escrow services became smarter, more efficient - enabling faster, secure, scalable solutions for our BFSI clients.

Ritesh Tiwari

Chief Product Officer, Castler

Platform Capabilities

No-code model training and deployment

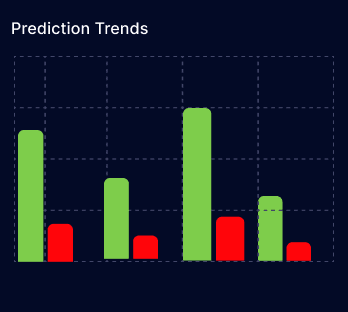

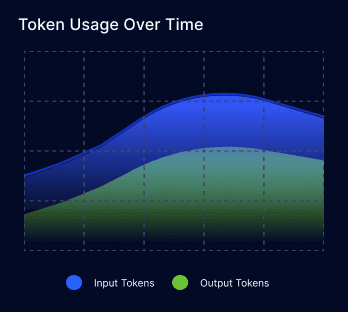

Integrated monitoring for drift, accuracy, and performance

Feature stores, model comparison, and one-click deployment

One Solution AI and Agentic AI Working Together.

Two secure platforms. One Vertical Solution. Many powerful outcomes.

Whether your deploying fraud models or launching an agent for claims assistance, this solution brings everything into one secure solution that scales with your insurance business.

Unified Agentic AI and AI Studios for faster development

ISO 42001, ISO 27001, SOC 2, HIPAA certified and GDPR compliant

Real-time dashboards and alerts for continuous oversight

Cloud or on-prem deployment with no vendor lock-in

Predictable scaling with lower cost per use case

Unified Agentic AI and AI Studios for faster development

ISO 42001, ISO 27001, SOC 2, HIPAA certified and GDPR compliant

Real-time dashboards and alerts for continuous oversight

Cloud or on-prem deployment with no vendor lock-in

Predictable scaling with lower cost per use case

Built for the Complexity

of the Insurance Industry

This purpose-built solution is proven across diverse insurance environments to

drive speed, efficiency, and accuracy where it counts the most.

0

2

4

5

0

5

0

0

%

faster time to market for AI and Agentic AI use cases

0

2

4

6

0

7

5

0

%

reduction in TCO

0

3

6

8

0

0

3

0

%

drop in manual tasks across claims and servicing

0

1

2

3

0

4

7

0

days or less to go live with AI use cases and Agentic AI in hours.

Real Customer Quotes

Mr. Ritesh Rathod

Mr. Stefano Bonfa

Mr. Neeraj Kulkarni

Great expertise and analytical diligence by DSW UnifyAI in developing an end-to-end data pipeline - making analytical insights available in the form of interactive, advanced dashboards

Mr. Neeraj Kulkarni

President / Chief Data Scientist

CIEK Solutions

Mr. Ritesh Tiwari

Ready for the Future

of Insurance AI

This purpose-built solution for insurers isn't just built for today's problems. It’s built for tomorrow’s scale. AI in insurance is moving beyond pilots and isolated use cases. This solution is building what's next- an integrated operating system with domain-specific capabilities like:

01

Industry's first verticalized SLM (Small Language Model) for insurance

02

Continuous learning from operational feedback

03

Modular expansion into newer lines of business and territories

Frequently Asked Questions

Get a Full Demo

Fill out the form

Get a Walkthrough

Fill out the form